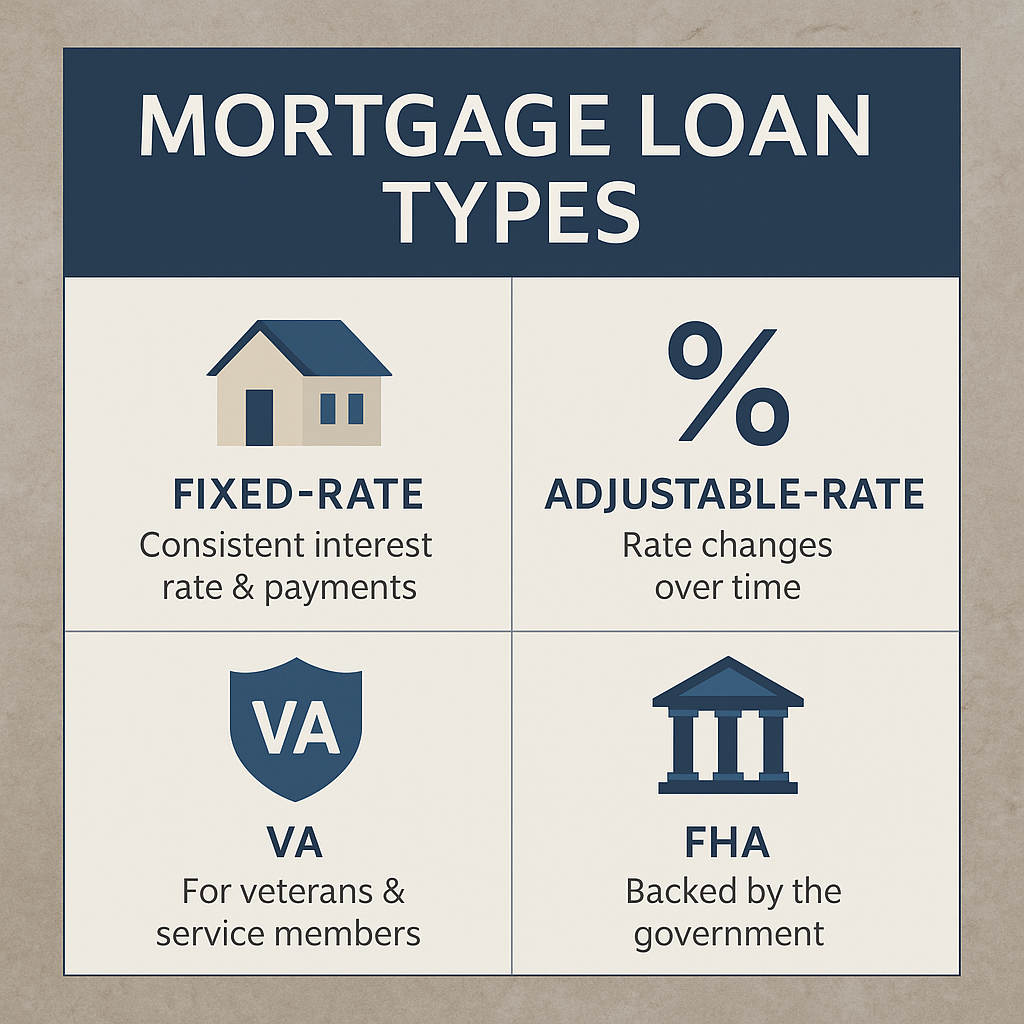

Mortgage Guide: VA, FHA & Conventional Loans Explained Understanding mortgage options doesn’t have to be…

Things To Avoid After Applying for a Home Loan

What Not to Do After Applying for a Mortgage

Applying for a home loan is a big step toward homeownership, but your job isn’t finished once the paperwork is submitted. During the loan approval process, lenders carefully review your financial profile, and minor missteps can cause big delays or even derail your approval.

Here are key things to avoid after applying for a mortgage to keep your loan on track.

1. Avoid Depositing Large Amounts of Cash

Cash is difficult to document and track. Lenders need to verify the source of all funds used in your transaction. Depositing untraceable cash into your account without proper documentation can raise red flags and slow down your approval. Before depositing any cash, speak with your loan officer to ensure it won’t become an issue.

2. Avoid Making Large Purchases

It’s tempting to start buying furniture or appliances for your new home, but hold off until after closing. Large purchases—whether it’s a new car, home goods, or electronics—can impact your debt-to-income ratio (DTI) and may cause you to no longer qualify for your loan. Even a “same-as-cash” deal or interest-free financing can hurt your application.

3. Avoid Co-Signing for Someone Else’s Loan

Co-signing a loan becomes part of your financial responsibility, even if someone else is making the payments. This adds to your debt load and increases your DTI, which can directly affect your mortgage approval.

4. Don’t Change Bank Accounts

Consistency is key. Lenders need to see a stable financial picture, including the flow of money in and out of your accounts. Changing banks or moving money between accounts during the loan process can make it harder to document assets. If you must make changes, always speak to your lender first.

5. Don’t Open New Credit Accounts

Every time your credit is pulled—whether for a new credit card, auto loan, or store financing—it can temporarily lower your credit score. Multiple credit inquiries and new accounts could reduce your score or make you appear financially unstable to underwriters. Avoid applying for any new credit until your loan has closed.

6. Don’t Close Existing Credit Accounts

It might seem wise to close unused credit cards, but doing so can backfire. Your credit utilization ratio and the length of your credit history are important factors in your credit score. Closing accounts can reduce your available credit and shorten your credit history, both of which can negatively impact your score.

7. Always Consult Your Loan Officer First

If you’re unsure about a financial move—no matter how small—reach out to your loan officer. Changes to income, job status, spending, savings, or credit should always be discussed before taking action. What seems harmless might be the reason a loan gets delayed or denied.

Bottom Line

Your goal is to reach the closing table with as few obstacles as possible. That means keeping your financial picture steady and transparent. Talk to your lender before making any big purchases, transferring money, or changing your credit profile. It could be the difference between a smooth approval and a stressful delay.

Do you need mortgage guidance or have questions about your current home loan application? Contact me today for personalized advice. I’m here to help every step of the way.